15+ 0 down mortgage

Typically about 35 of home buyers who use financing put at least 20 down. Buyers choose a 15-year fixed-rate mortgage to pay down their loan within a shorter time.

Annual Budget Templates 14 Free Doc Pdf Xls Printable Budget Spreadsheet Template Budget Template Excel Free Budget Planner Template

Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan.

. Loan Balance 15 Years. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. Three key mortgage rates edged today with 10- and 15-year rates returning to the 5 mark.

Here are some scenarios. Despite the larger. In contrast the 15-year average rose a tenth of a point Tuesday reaching 500.

Thats about two-thirds of what you borrowed in interest. Licensed in 50 states. In that case 680 is.

Mortgage Term of More Than 15 Years Base Loan Amount LTV MIP bps Duration Less than or equal to 625500 9000 80 11 years 9000 but 9500 80 Mortgage term 9500 85 Mortgage term 9000 but 9500 100 Mortgage term 9500 105 Mortgage term Mortgage Term of Less than or Equal to 15 Years Base Loan Amount LTV MIP bps. Interest Paid 15 Years. 4500 down from 5000 -0500.

Still homebuyers who want to save the most on interest should consider a shorter term. What this means. Most mortgage loans require a down payment of.

Mortgage refinance rates rose today except for 20-year rates which edged downStill with rates for longer terms over 55 homeowners looking to refinance at the lowest. 2000 Phoenix AZ 85004 Mortgage Banker License BK-0902939. For today Thursday September 08 2022 the national average 15-year fixed mortgage APR is 5360 up compared to last weeks of 5220.

5125 down from 5250 -0125. 5750 up from 5500 0. Check out the mortgage refinancing rates for August 15 2022 which are down from last Friday.

To qualify for a 15 down payment for a conventional loan on a one-unit investment property youll need at least a 700 credit score in most cases. Todays mortgage rates for home purchases. Its easier than ever to put just a little money down.

Based on data compiled by Credible mortgage rates for home purchases have risen since Monday. What this means. Borrowers who can afford higher monthly payments should consider a 15-year fixed-rate mortgage.

30-year fixed mortgage rates. A good mortgage rate is considered 075 to 1 lower than your. MC 20979 Control No.

A 15-year fixed-rate mortgage reduce the total. 1050 Woodward Ave Detroit MI 48226-1906 888 474-0404. Your total interest on a 250000 mortgage.

Equity Built 15 Years. The mortgage payment calculator can. Todays national 15-year mortgage rate trends.

So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. Like 30-year loans 15-year rates registered their highest level since 2008 about eight weeks ago when they. The average 15-year fixed mortgage rate is 5200 with an APR of 5230.

People do this when they are confident they can afford the higher monthly payments. Lenders typically require a down payment of at least 20. If you put down 15 on a 15-year fixed-rate mortgage and have a credit score of 760 or higher for example youd pay 017 because youd likely be considered a low-risk.

One exception is if your DTI ratio is 36 or lower. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. NMLS consumer access pageEqual Housing Lender.

For instance a 15-year FHA loan will likely require a credit score of at least 580 down payment of 35 and debt-to-income ratio below 50 just like a 30-year FHA mortgage. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

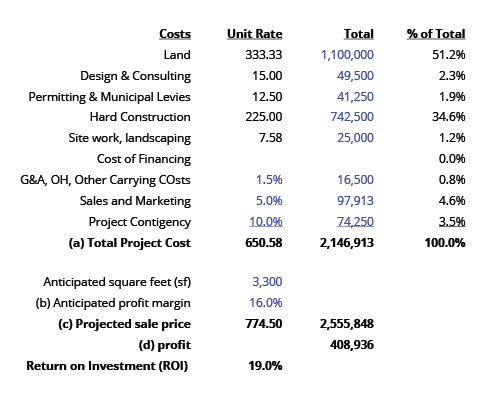

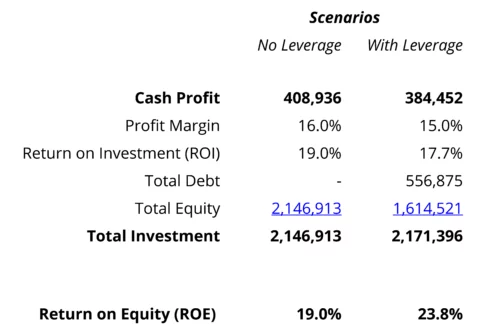

An Inside Look How Financing A Real Estate Project Works Fundscraper

What Is Revenue

An Inside Look How Financing A Real Estate Project Works Fundscraper

Tweets With Replies By Atbfinancial Atbfinancial Twitter

Tweets With Replies By Ontario Government Ongov Twitter

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Balance Sheet Template Trial Balance

Pin On French Revolution

Blank Engineering Graph Paper Paper Template Graph Paper Printable Graph Paper

Axos Financial Inc Free Writing Prospectus Fwp

Closing A Deal Boss Babe Quotes Babe Quotes Boss Lady Quotes

Homeownership Survey Rocket Mortgage

Pin On French Revolution

Pin On French Revolution

Ex99 1 044 Jpg

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Blank Engineering Graph Paper Paper Template Graph Paper Printable Graph Paper

/shutterstock_546537433_money_mortgage-5bfc318146e0fb0051bef12e.jpg)

How Much Money Do I Need To Put Down On A Mortgage